Oluwatoyin Aralepo is a first class accounting graduate, Fellow of the Institute of Chartered Accountant of Nigeria (ICAN), Fellow of the Institute of Information Management of Africa and an Alumna of the London School of Business and Finance (LSBF), with over 15 years’ wealth of experience across Banking, Telecoms and Fintech.

Areas of expertise include finance strategy and business partnering, financial planning, analysis & reporting, audit and business assurance, financial controls and governance. She was the Head of Budget in UBA – responsible for over400 business offices budget preparation and consolidation; Commercial Controller and Financial Controller at Airtel.

Nigeria where she managed portfolio of over lbn dollar and supported cost initiatives that saved millions of dollars, and former CFO of Cellulant Nigeria. She recently founded Africa Finance & Strategy Hub to support businesses especially SMES have access to professional financial management skills, and tools that will help them understand, manage and scale their businesses. She wants to help businesses build sustainable financial structures for profitable growth and become investor ready.

She is a very passionate and unassuming entrepreneurial role model to young women. She is a mentor of Wimbiz, Tony Elumelu Foundation, Tech-quest STEM Academy to mention a few. She is married and blessed with two lovely daughters.

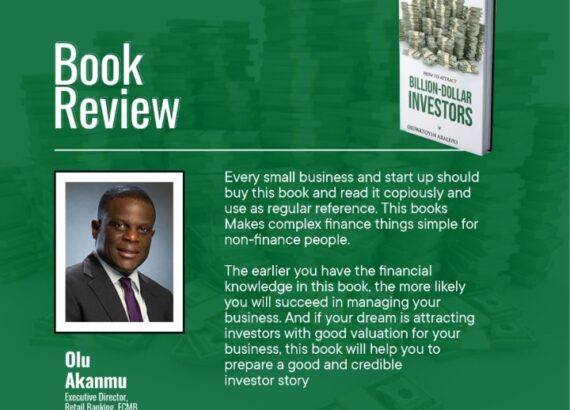

In this Interview with Oyinlola Sale, she tells us about the story behind her book, ”How to attract Billion Dollar Investors”.

Over the years, you area of Areas of expertise has been finance strategy & business partnering, financial planning, analysis & reporting, audit and business assurance, financial controls and governance. So when did you realize you had to channel it to write your book?

I believe strongly that the wealth of my experience will make businesses adopt best practices at an early stage

As the Founder of Africa Finance & Strategy Hub I’m on a mission to support businesses especially SMES.

To help businesses especially SMES access and enjoy the same value of a multinational CFO.

To give them access to professional financial management skills, and tools that will assist them to understand, manage and scale their businesses.

To help business owners make smart financial decisions to grow profit and attract investors for funding and expansion.

To help business owners struggling with the performance of their businesses build sustainable financial structures for profitable growth.

Is it capital intensive to publish a book of your Magnitude in Nigeria?

This is relative and depends on the channels and mode of publication. I wanted a book that people can access both digitally and physically for those that love reading physical books.

What were some of the challenges you have faced so far in pursuing your passion in the financial sector in Nigeria?

As an entrepreneur you need to build the Know, Like & Trust factor and have visibility to reach out to the business owners that need support in building the right financial structure that will help their businesses to scale.

This book will help them identify what stage their businesses are and show them how to position for funding opportunities?

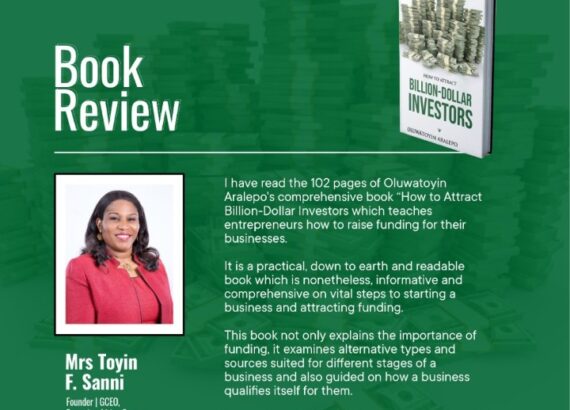

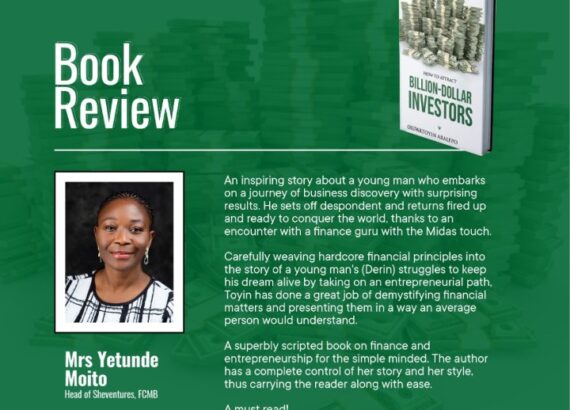

It is informative and comprehensive on vital steps to starting a business, attracting funding and it makes complex finance principles simple for non-finance people. This is not just any other finance book. I have carefully woven hard-core financial principles into the story of a young man named Derin struggling to keep his dream alive by taking on an entrepreneurial path.

The storyline has relatable characters around core business and accounting principles.

The earlier business owners have the financial knowledge in this book, the more likely they will succeed in managing their businesses.

At the end of this book, they will be able to recognize and stop practices that may be hurting their businesses so that they too, can attract billion-dollar investors.

What would be an ideal plan to structure the economy of Nigeria with your wealth of experience?

Nigeria’s economic potential is inhibited by many structural issues, including inadequate infrastructure, tariff and non-tariff barriers to trade, obstacles to investment, lack of confidence in currency valuation, and limited foreign exchange capacity.

Policies and actions need to be broad based, focused on infrastructural development and intentional in reducing poverty for economic stability.

It has to be based on optimal participation of both private and public sector. Enhancement of capital projects and infrastructure to encourage ease of doing business, reduce dependency on imports and consumptions that will help to expand the production base of the economy and enhance the labour productivity.

Address the issue of insecurity across the country, address bureaucracy and corruption across the major sectors.

Leverage on digital technologies to improve financial literacy and create jobs for the youth and SMEs.

Leverage trade integration to harness the benefits of the Africa Continental Free Trade Area.

These are some of the critical levers that need to be improved to enable Nigeria reach its socio- economic targets.

What policies can the Government put in place to support the SMEs in Nigeria?

Government can launch Business Growth Incubator and accelerator programs provide support and guidance to SMEs that are struggling to maximise the growth potential of their businesses.

Establish Business advisory hub to support businesses get Financial education & literacy awareness free or at subsidized costs. The government can help organize and subsidize networking, conferences and other collaboration events, as well as trade shows where SMEs can participate at a much lower cost than a regular commercial event. Such government sponsored platforms, whether industry-specific or general, are very effective in helping SMEs attract customers and business partners.

SMEs can get expert support and advice on key issues from finance and cash flow to recruitment and staff development, and from marketing to making the most of digital technologies. As well as advice on business plans and mentoring for ambitious entrepreneurs.

Provide infrastructures to reduce the cost of doing business in Nigeria- fuel, electricity.

Offer Start up loans to provide financial opportunities.

Streamline the tax polocies to avoid multiple taxes and levies across local giverstanments, states and federal government to ensure transpararecny and opportunities available to various businesses.

Promote mental health: The last measure is more psychological support. This has been a neglected area in the past, but improving business owners’ mental health is as effective as building a stronger network or increasing cash flow.

Looking at the economy in Nigeria, where do you think entrepreneurs can come in to bridge the gap?

SMEs are catalysts for growth and social economic transformation. They do this by production and, manufacturing activities that lead to creation of jobs and reducing the poverty rate. These have multiplier effect on growth the wealth of the nation.